Germany between economic stimulus and trade war

Boosted by the adoption of a historic financial package that promises large-scale public investment, the German stock market was recently shaken by mounting uncertainty over steep US import tariffs. Since the beginning of the year, the DAX had gained more than 13 percent, only to plunge by around 10 percent at market opening on 7 April following Trump’s sweeping tariff announcement.

On the one hand, the justified hopes for an economic recovery offer a glimmer of hope for Germany’s stagnating economy. On the other hand, external risks—particularly the prospect of rising global trade restrictions—are weighing heavily on the country’s economic outlook.

Tariffs as a risk factor

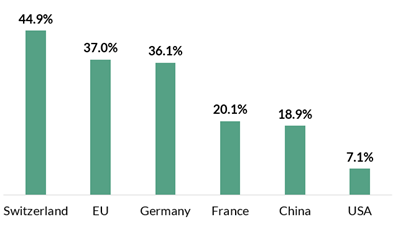

The announcement of US tariffs on European imports puts Germany’s export-driven economy to the test. Goods exports account for 36.1 percent of German GDP (source: Statistisches Bundesamt), making the country particularly vulnerable to rising trade barriers. In comparison, the export share is just 7.1 percent in the US and 18.9 percent in China.

Figure 1: Exports of goods as % of GDP

Source: National Bureau of Statistics of China, Statistisches Bundesamt, EU-Kommission (AMECO)

Germany’s economic growth is therefore currently largely based on free trade and global value chains. Germany’s export orientation is considered as a sign of economic strength and the competitiveness of German companies. However, following the Trump administration’s decision to adopt a radical tariff policy, Germany’s high dependence on exports has increasingly become a burden on growth.

USA as an important trading partner

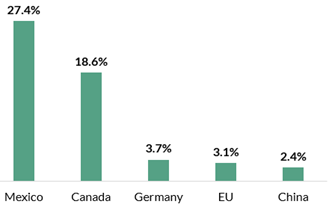

The United States is a major trading partner for Germany, accounting for 10.4 percent of total German goods exports. In 2024, Germany exported goods worth approximately EUR 161.4 billion to the U.S. Given a GDP of around EUR 4.3 trillion, this corresponds to 3.7% of Germany’s gross domestic product. In comparison with other countries affected by US tariffs, this level of dependency remains economically manageable for Germany. Countries such as Canada or Mexico are significantly more reliant on U.S. demand than Germany.

Figure 2: Exports to the U.S. as % of GDP

Source: Eurostat, Statistisches Bundesamt

EU single market as a stabiliser

The importance of the EU area for German exports is significantly greater than that of the United States. More than 50 percent of Germany’s exports go to partners within the European Union. As a result, intra-EU free trade is far more critical to the German economy than transatlantic trade. This close economic integration within the EU contributes significantly to the stability of Germany’s external trade, particularly in times of global uncertainty. A deeper European integration strengthens growth and is now more necessary than ever considering Trump’s economically irrational tariff policy.

China could compete with German exports

One risk arising from the US–China trade war is that Chinese goods may increasingly be redirected to European markets. With US tariffs on Chinese imports exceeding 100 percent, Chinese exports to the United States have become significantly less competitive. In search of alternative markets, China began strengthening its trade ties with the EU as early as 2018, following the introduction of 25 percent US tariffs on Chinese products — a shift that has favoured China’s trade balance.

The German economy will grow again in 2026

The EUR 500 billion financial package approved by a two-thirds majority in the Bundestag as a special fund could help resolve the backlog in public investment and stimulate private sector activity. According to German research institutes and business associations, the most pressing investment needs are in the areas of transport, education, and climate protection.1 Following the adoption of this historic fiscal package, Oxford Economics significantly revised its growth forecasts upward: real GDP growth is now expected to reach 1.8 percent in 2026 (+0.7 percentage point compared to the previous forecast) and 2.6 percent in 2027 (+1.3 percentage points). The German stock market responded positively, appreciating sharply in reaction to the increased fiscal stimulus.

The coalition agreement concluded between the CDU, CSU and SPD on Wednesday, 9 April 2025 has both light and shadows. The positive elements include tax relief for companies and higher depreciation allowances. The degressive depreciation of equipment investments of 30 percent in the years 2025 to 2027 is to be welcomed. From 2028, corporation tax is to be reduced from the current 15 percent by one percentage point in five stages. These and other tax relief and the urgently needed fight against excessive bureaucracy could lead to higher investment in Germany in the long term. In addition, the electricity tax is to be lowered, and levies and grid fees reduced. This will provide urgently needed relief for energy-intensive companies in Germany. It is also worth noting that—although modest—some personal income tax relief is planned, such as the tax exemption for overtime pay and the increase of the commuter allowance starting in 2026. Importantly, the SPD’s demands for the reintroduction of a wealth tax and an increase in the capital gains tax were not included in the coalition agreement. Nevertheless, further fiscal policy initiatives from the SPD—which will hold the finance ministry in the new government—can be expected over the course of the legislative term. Unfortunately, the solidarity surcharge will remain unchanged. The urgently needed pension system reform, made more pressing by demographic shifts, has been postponed. Our assessment of the coalition agreement: a hesitant step in the right direction.

The historic financial package and the largely positive reception of the coalition agreement could provide positive impetus for the real economy and the German capital market. However, growing uncertainty surrounding US trade tariffs continue to weigh on export-oriented economies. That said, Germany’s reliance on American consumers remains limited—what matters far more is the free movement of goods within the European Union, which, considering geopolitical risks and a weakened transatlantic relationship, will hopefully grow closer together.

1) Sources: Federation of German Industries; Institute for Macroeconomics and Business Cycle Research.

Disclaimer

This document has been prepared by ODDO BHF for information purposes only. It does not create any obligations on the part of ODDO BHF. The opinions expressed in this document correspond to the market expectations of ODDO BHF at the time of publication. They may change according to market conditions and ODDO BHF cannot be held contractually responsible for them. Any references to single stocks have been included for illustrative purposes only. Before investing in any asset class, it is strongly recommended that potential investors make detailed enquiries about the risks to which these asset classes are exposed, in particular the risk of capital loss.

ODDO BHF

12, boulevard de la Madeleine – 75440 Paris Cedex 09 France – Phone: 33(0)1 44 51 85 00 – Fax: 33(0)1 44 51 85 10 –www.oddo-bhf.com ODDO BHF SCA, a limited partnership limited by shares with a capital of €73,193,472- – RCS 652 027 384 Paris –

Approved as a credit institution by the Autorité de Contrôle Prudentiel et de Résolution (ACPR) and registered with ORIAS as an insurance broker under number 08046444. – www.oddo-bhf.com